What Is The Sales Tax Rate On A Vehicle In Louisiana . The calculator will show you the total. How to use this calculator. In addition to taxes, car. Louisiana collects a 4% state sales tax rate on the purchase of all vehicles. This publication has been prepared as a brief guide to the louisiana state sales and use taxes on motor vehicles used in louisiana. According to autobytel, all cars purchased in louisiana are subject to a 4% state sales tax regardless of whether they are in new. There are also local taxes of up to 6%. Fill in the fields with the. 521 rows louisiana has state sales tax of 4.45% , and allows local governments to collect a local option sales tax of up to 7%. You can use our louisiana sales tax calculator to look up sales tax rates in louisiana by address / zip code. There are a total of. This calculator helps you estimate the sales tax for purchasing a vehicle in louisiana.

from www.theadvocate.com

How to use this calculator. You can use our louisiana sales tax calculator to look up sales tax rates in louisiana by address / zip code. This calculator helps you estimate the sales tax for purchasing a vehicle in louisiana. There are a total of. The calculator will show you the total. This publication has been prepared as a brief guide to the louisiana state sales and use taxes on motor vehicles used in louisiana. Louisiana collects a 4% state sales tax rate on the purchase of all vehicles. There are also local taxes of up to 6%. Fill in the fields with the. 521 rows louisiana has state sales tax of 4.45% , and allows local governments to collect a local option sales tax of up to 7%.

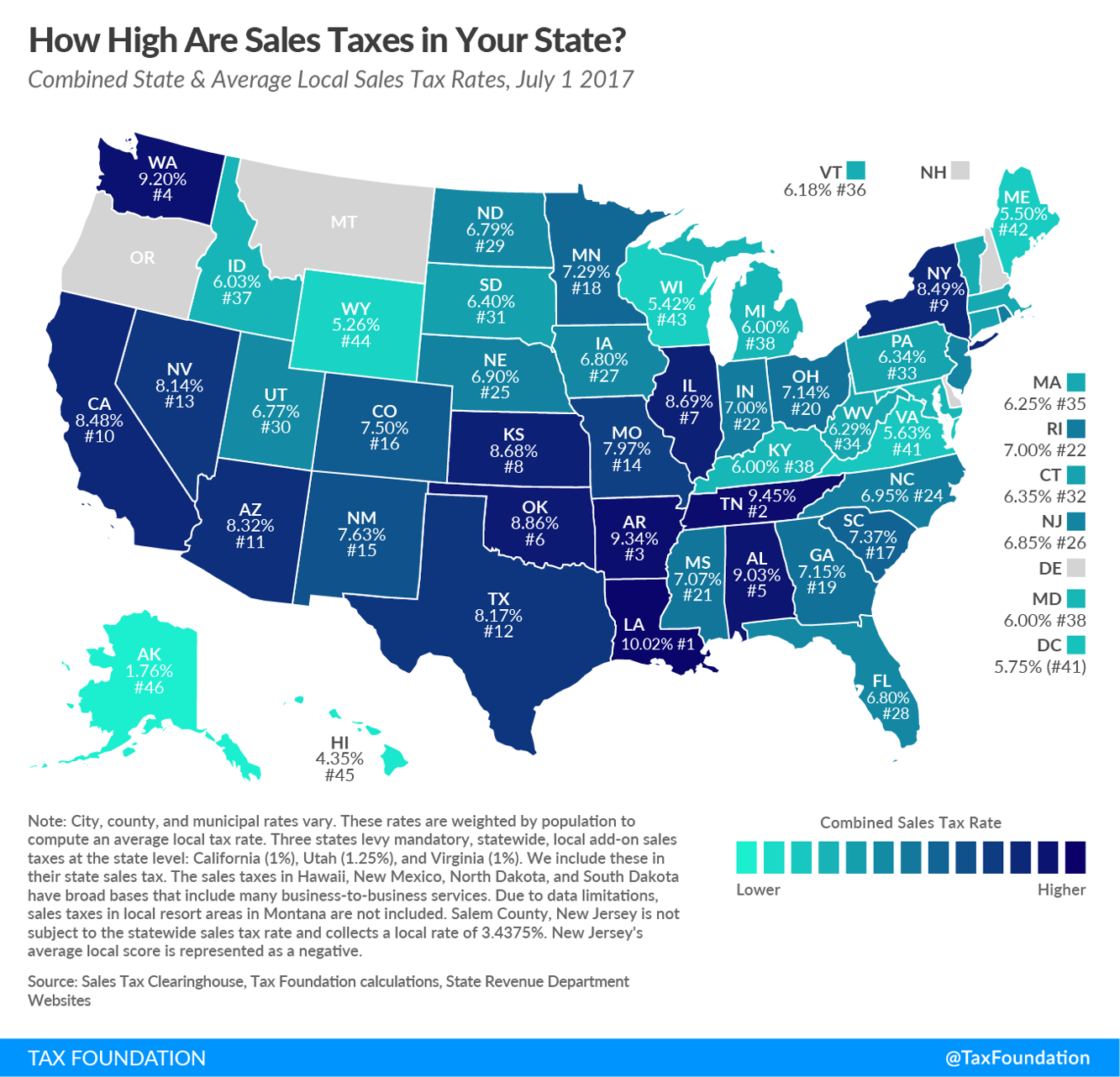

Louisiana sales tax rate remains highest in the U.S. Legislature

What Is The Sales Tax Rate On A Vehicle In Louisiana This publication has been prepared as a brief guide to the louisiana state sales and use taxes on motor vehicles used in louisiana. There are a total of. How to use this calculator. Louisiana collects a 4% state sales tax rate on the purchase of all vehicles. You can use our louisiana sales tax calculator to look up sales tax rates in louisiana by address / zip code. According to autobytel, all cars purchased in louisiana are subject to a 4% state sales tax regardless of whether they are in new. The calculator will show you the total. Fill in the fields with the. There are also local taxes of up to 6%. 521 rows louisiana has state sales tax of 4.45% , and allows local governments to collect a local option sales tax of up to 7%. This calculator helps you estimate the sales tax for purchasing a vehicle in louisiana. In addition to taxes, car. This publication has been prepared as a brief guide to the louisiana state sales and use taxes on motor vehicles used in louisiana.

From www.semashow.com

Lv The Garden Sales Tax Rate What Is The Sales Tax Rate On A Vehicle In Louisiana Fill in the fields with the. The calculator will show you the total. How to use this calculator. In addition to taxes, car. There are a total of. This calculator helps you estimate the sales tax for purchasing a vehicle in louisiana. There are also local taxes of up to 6%. According to autobytel, all cars purchased in louisiana are. What Is The Sales Tax Rate On A Vehicle In Louisiana.

From www.carsalerental.com

How To Figure Sales Tax On A Car Car Sale and Rentals What Is The Sales Tax Rate On A Vehicle In Louisiana There are also local taxes of up to 6%. 521 rows louisiana has state sales tax of 4.45% , and allows local governments to collect a local option sales tax of up to 7%. This publication has been prepared as a brief guide to the louisiana state sales and use taxes on motor vehicles used in louisiana. Fill in the. What Is The Sales Tax Rate On A Vehicle In Louisiana.

From formspal.com

Free Louisiana Bill of Sale Forms (PDF) FormsPal What Is The Sales Tax Rate On A Vehicle In Louisiana There are a total of. 521 rows louisiana has state sales tax of 4.45% , and allows local governments to collect a local option sales tax of up to 7%. How to use this calculator. This calculator helps you estimate the sales tax for purchasing a vehicle in louisiana. Fill in the fields with the. This publication has been prepared. What Is The Sales Tax Rate On A Vehicle In Louisiana.

From slyviahubert.blogspot.com

how to calculate sales tax in oklahoma Slyvia Hubert What Is The Sales Tax Rate On A Vehicle In Louisiana You can use our louisiana sales tax calculator to look up sales tax rates in louisiana by address / zip code. 521 rows louisiana has state sales tax of 4.45% , and allows local governments to collect a local option sales tax of up to 7%. There are also local taxes of up to 6%. According to autobytel, all cars. What Is The Sales Tax Rate On A Vehicle In Louisiana.

From www.sales-taxes.com

71066 Sales Tax Rate LA Sales Taxes By ZIP July 2024 What Is The Sales Tax Rate On A Vehicle In Louisiana 521 rows louisiana has state sales tax of 4.45% , and allows local governments to collect a local option sales tax of up to 7%. How to use this calculator. There are a total of. Fill in the fields with the. The calculator will show you the total. There are also local taxes of up to 6%. You can use. What Is The Sales Tax Rate On A Vehicle In Louisiana.

From taxwalls.blogspot.com

How Much Are Property Taxes In Louisiana Tax Walls What Is The Sales Tax Rate On A Vehicle In Louisiana The calculator will show you the total. There are a total of. In addition to taxes, car. According to autobytel, all cars purchased in louisiana are subject to a 4% state sales tax regardless of whether they are in new. You can use our louisiana sales tax calculator to look up sales tax rates in louisiana by address / zip. What Is The Sales Tax Rate On A Vehicle In Louisiana.

From taxfoundation.org

2022 Sales Tax Rates State & Local Sales Tax by State Tax Foundation What Is The Sales Tax Rate On A Vehicle In Louisiana This publication has been prepared as a brief guide to the louisiana state sales and use taxes on motor vehicles used in louisiana. In addition to taxes, car. Fill in the fields with the. How to use this calculator. Louisiana collects a 4% state sales tax rate on the purchase of all vehicles. According to autobytel, all cars purchased in. What Is The Sales Tax Rate On A Vehicle In Louisiana.

From almirabcosetta.pages.dev

Wv State Tax Rates 2024 Lonni Randene What Is The Sales Tax Rate On A Vehicle In Louisiana Louisiana collects a 4% state sales tax rate on the purchase of all vehicles. There are also local taxes of up to 6%. You can use our louisiana sales tax calculator to look up sales tax rates in louisiana by address / zip code. Fill in the fields with the. According to autobytel, all cars purchased in louisiana are subject. What Is The Sales Tax Rate On A Vehicle In Louisiana.

From www.chegg.com

Solved Joumalizing Sales TransactionsEnter the following What Is The Sales Tax Rate On A Vehicle In Louisiana In addition to taxes, car. You can use our louisiana sales tax calculator to look up sales tax rates in louisiana by address / zip code. This publication has been prepared as a brief guide to the louisiana state sales and use taxes on motor vehicles used in louisiana. How to use this calculator. There are also local taxes of. What Is The Sales Tax Rate On A Vehicle In Louisiana.

From taxfoundation.org

Weekly Map State and Local Sales Tax Rates, 2013 Tax Foundation What Is The Sales Tax Rate On A Vehicle In Louisiana You can use our louisiana sales tax calculator to look up sales tax rates in louisiana by address / zip code. The calculator will show you the total. 521 rows louisiana has state sales tax of 4.45% , and allows local governments to collect a local option sales tax of up to 7%. Louisiana collects a 4% state sales tax. What Is The Sales Tax Rate On A Vehicle In Louisiana.

From www.lao.ca.gov

Understanding California’s Sales Tax What Is The Sales Tax Rate On A Vehicle In Louisiana This calculator helps you estimate the sales tax for purchasing a vehicle in louisiana. In addition to taxes, car. There are also local taxes of up to 6%. There are a total of. You can use our louisiana sales tax calculator to look up sales tax rates in louisiana by address / zip code. How to use this calculator. 521. What Is The Sales Tax Rate On A Vehicle In Louisiana.

From www.youtube.com

Discount & Sales Tax Word Problems (6 EXAMPLES!!) YouTube What Is The Sales Tax Rate On A Vehicle In Louisiana Louisiana collects a 4% state sales tax rate on the purchase of all vehicles. You can use our louisiana sales tax calculator to look up sales tax rates in louisiana by address / zip code. There are a total of. The calculator will show you the total. This publication has been prepared as a brief guide to the louisiana state. What Is The Sales Tax Rate On A Vehicle In Louisiana.

From www.dochub.com

Louisiana state tax Fill out & sign online DocHub What Is The Sales Tax Rate On A Vehicle In Louisiana Fill in the fields with the. 521 rows louisiana has state sales tax of 4.45% , and allows local governments to collect a local option sales tax of up to 7%. In addition to taxes, car. You can use our louisiana sales tax calculator to look up sales tax rates in louisiana by address / zip code. This publication has. What Is The Sales Tax Rate On A Vehicle In Louisiana.

From legaltemplates.net

Free Louisiana Bill of Sale Forms PDF & Word Legal Templates What Is The Sales Tax Rate On A Vehicle In Louisiana There are a total of. The calculator will show you the total. This publication has been prepared as a brief guide to the louisiana state sales and use taxes on motor vehicles used in louisiana. Fill in the fields with the. This calculator helps you estimate the sales tax for purchasing a vehicle in louisiana. There are also local taxes. What Is The Sales Tax Rate On A Vehicle In Louisiana.

From www.formsbank.com

Form R1029 Louisiana Sales Tax Return printable pdf download What Is The Sales Tax Rate On A Vehicle In Louisiana According to autobytel, all cars purchased in louisiana are subject to a 4% state sales tax regardless of whether they are in new. How to use this calculator. 521 rows louisiana has state sales tax of 4.45% , and allows local governments to collect a local option sales tax of up to 7%. This publication has been prepared as a. What Is The Sales Tax Rate On A Vehicle In Louisiana.

From www.formsbank.com

Fillable Sales And Use Tax Report Louisiana Department Of Revenue What Is The Sales Tax Rate On A Vehicle In Louisiana According to autobytel, all cars purchased in louisiana are subject to a 4% state sales tax regardless of whether they are in new. You can use our louisiana sales tax calculator to look up sales tax rates in louisiana by address / zip code. Fill in the fields with the. There are also local taxes of up to 6%. The. What Is The Sales Tax Rate On A Vehicle In Louisiana.

From taxfoundation.org

Monday Map Combined State and Local Sales Tax Rates What Is The Sales Tax Rate On A Vehicle In Louisiana How to use this calculator. There are a total of. Fill in the fields with the. This calculator helps you estimate the sales tax for purchasing a vehicle in louisiana. There are also local taxes of up to 6%. This publication has been prepared as a brief guide to the louisiana state sales and use taxes on motor vehicles used. What Is The Sales Tax Rate On A Vehicle In Louisiana.

From danieljmitchell.wordpress.com

BluetoRed Migration, Part III The SlowMotion Suicide of HighTax What Is The Sales Tax Rate On A Vehicle In Louisiana 521 rows louisiana has state sales tax of 4.45% , and allows local governments to collect a local option sales tax of up to 7%. Fill in the fields with the. In addition to taxes, car. You can use our louisiana sales tax calculator to look up sales tax rates in louisiana by address / zip code. This calculator helps. What Is The Sales Tax Rate On A Vehicle In Louisiana.