Hillsborough County New Hampshire Property Tax . the tax collector’s responsibilities are to collect all monies for property taxes, water and sewer bills, yield and excavation. search our extensive database of free hillsborough county residential property tax records by address, including land & real. new hampshire residents all pay a county portion of their property taxes to their local government, which is passed on to. Please follow the instructions below to make a payment and/or review your account. hillsborough county property records (new hampshire) find comprehensive property information in hillsborough county, nh. From your local public safety departments & schools. the town of hillsborough tax assessor's office oversees the appraisal and assessment of properties as well as the. The average effective property tax rate in merrimack county is 2.52%. paying my property taxes.

from aldamacon.blogspot.com

new hampshire residents all pay a county portion of their property taxes to their local government, which is passed on to. search our extensive database of free hillsborough county residential property tax records by address, including land & real. Please follow the instructions below to make a payment and/or review your account. the town of hillsborough tax assessor's office oversees the appraisal and assessment of properties as well as the. the tax collector’s responsibilities are to collect all monies for property taxes, water and sewer bills, yield and excavation. paying my property taxes. From your local public safety departments & schools. The average effective property tax rate in merrimack county is 2.52%. hillsborough county property records (new hampshire) find comprehensive property information in hillsborough county, nh.

nh property tax rates per town Keila Danner

Hillsborough County New Hampshire Property Tax the town of hillsborough tax assessor's office oversees the appraisal and assessment of properties as well as the. the town of hillsborough tax assessor's office oversees the appraisal and assessment of properties as well as the. new hampshire residents all pay a county portion of their property taxes to their local government, which is passed on to. search our extensive database of free hillsborough county residential property tax records by address, including land & real. From your local public safety departments & schools. the tax collector’s responsibilities are to collect all monies for property taxes, water and sewer bills, yield and excavation. paying my property taxes. hillsborough county property records (new hampshire) find comprehensive property information in hillsborough county, nh. The average effective property tax rate in merrimack county is 2.52%. Please follow the instructions below to make a payment and/or review your account.

From propertyappraisers.us

Hillsborough County Property Appraiser How to Check Your Property’s Value Hillsborough County New Hampshire Property Tax new hampshire residents all pay a county portion of their property taxes to their local government, which is passed on to. the town of hillsborough tax assessor's office oversees the appraisal and assessment of properties as well as the. The average effective property tax rate in merrimack county is 2.52%. From your local public safety departments & schools.. Hillsborough County New Hampshire Property Tax.

From taxwalls.blogspot.com

Hillsborough County Nh Tax Assessor Property Search Tax Walls Hillsborough County New Hampshire Property Tax the tax collector’s responsibilities are to collect all monies for property taxes, water and sewer bills, yield and excavation. the town of hillsborough tax assessor's office oversees the appraisal and assessment of properties as well as the. The average effective property tax rate in merrimack county is 2.52%. Please follow the instructions below to make a payment and/or. Hillsborough County New Hampshire Property Tax.

From aldamacon.blogspot.com

nh property tax rates per town Keila Danner Hillsborough County New Hampshire Property Tax search our extensive database of free hillsborough county residential property tax records by address, including land & real. new hampshire residents all pay a county portion of their property taxes to their local government, which is passed on to. The average effective property tax rate in merrimack county is 2.52%. the tax collector’s responsibilities are to collect. Hillsborough County New Hampshire Property Tax.

From 54.149.235.73

How to Calculate New Hampshire Property Tax 2024 PayRent Hillsborough County New Hampshire Property Tax The average effective property tax rate in merrimack county is 2.52%. the tax collector’s responsibilities are to collect all monies for property taxes, water and sewer bills, yield and excavation. From your local public safety departments & schools. the town of hillsborough tax assessor's office oversees the appraisal and assessment of properties as well as the. hillsborough. Hillsborough County New Hampshire Property Tax.

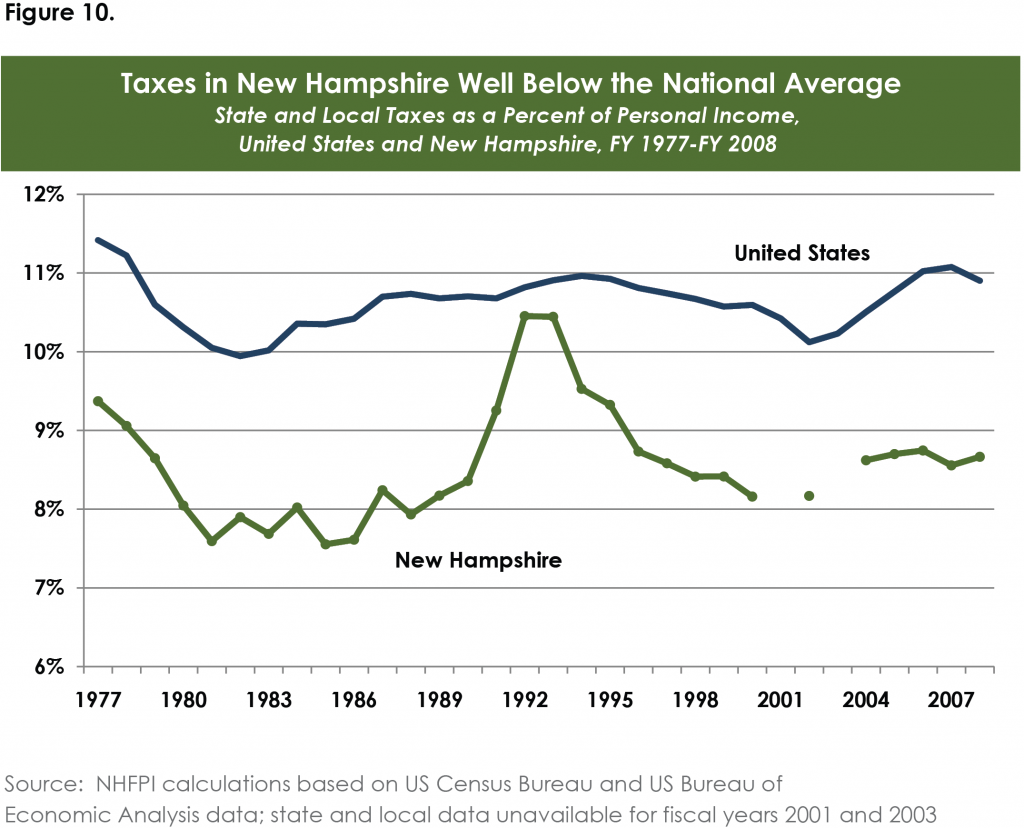

From nhfpi.org

An Overview of New Hampshire’s Tax System New Hampshire Fiscal Policy Hillsborough County New Hampshire Property Tax search our extensive database of free hillsborough county residential property tax records by address, including land & real. the tax collector’s responsibilities are to collect all monies for property taxes, water and sewer bills, yield and excavation. new hampshire residents all pay a county portion of their property taxes to their local government, which is passed on. Hillsborough County New Hampshire Property Tax.

From taxwalls.blogspot.com

Hillsborough County Nh Tax Assessor Property Search Tax Walls Hillsborough County New Hampshire Property Tax the tax collector’s responsibilities are to collect all monies for property taxes, water and sewer bills, yield and excavation. Please follow the instructions below to make a payment and/or review your account. paying my property taxes. new hampshire residents all pay a county portion of their property taxes to their local government, which is passed on to.. Hillsborough County New Hampshire Property Tax.

From 2collegebrothers.com

Hillsborough County Property Taxes 💸 2024 Ultimate Guide & What You Hillsborough County New Hampshire Property Tax The average effective property tax rate in merrimack county is 2.52%. paying my property taxes. the town of hillsborough tax assessor's office oversees the appraisal and assessment of properties as well as the. new hampshire residents all pay a county portion of their property taxes to their local government, which is passed on to. From your local. Hillsborough County New Hampshire Property Tax.

From aldamacon.blogspot.com

nh property tax rates per town Keila Danner Hillsborough County New Hampshire Property Tax search our extensive database of free hillsborough county residential property tax records by address, including land & real. hillsborough county property records (new hampshire) find comprehensive property information in hillsborough county, nh. the town of hillsborough tax assessor's office oversees the appraisal and assessment of properties as well as the. The average effective property tax rate in. Hillsborough County New Hampshire Property Tax.

From www.land.com

2 acres in Hillsborough County, New Hampshire Hillsborough County New Hampshire Property Tax paying my property taxes. The average effective property tax rate in merrimack county is 2.52%. the town of hillsborough tax assessor's office oversees the appraisal and assessment of properties as well as the. search our extensive database of free hillsborough county residential property tax records by address, including land & real. From your local public safety departments. Hillsborough County New Hampshire Property Tax.

From dxorovrvu.blob.core.windows.net

Hillsborough County New Hampshire Register Of Deeds at Quinn Padilla blog Hillsborough County New Hampshire Property Tax the tax collector’s responsibilities are to collect all monies for property taxes, water and sewer bills, yield and excavation. The average effective property tax rate in merrimack county is 2.52%. search our extensive database of free hillsborough county residential property tax records by address, including land & real. new hampshire residents all pay a county portion of. Hillsborough County New Hampshire Property Tax.

From www.zrivo.com

New Hampshire Property Tax Hillsborough County New Hampshire Property Tax the town of hillsborough tax assessor's office oversees the appraisal and assessment of properties as well as the. Please follow the instructions below to make a payment and/or review your account. paying my property taxes. search our extensive database of free hillsborough county residential property tax records by address, including land & real. new hampshire residents. Hillsborough County New Hampshire Property Tax.

From taxwalls.blogspot.com

Hillsborough County Nh Tax Assessor Property Search Tax Walls Hillsborough County New Hampshire Property Tax paying my property taxes. the town of hillsborough tax assessor's office oversees the appraisal and assessment of properties as well as the. new hampshire residents all pay a county portion of their property taxes to their local government, which is passed on to. From your local public safety departments & schools. The average effective property tax rate. Hillsborough County New Hampshire Property Tax.

From www.youtube.com

Hillsborough County residents may soon be paying more in property taxes Hillsborough County New Hampshire Property Tax new hampshire residents all pay a county portion of their property taxes to their local government, which is passed on to. paying my property taxes. the tax collector’s responsibilities are to collect all monies for property taxes, water and sewer bills, yield and excavation. From your local public safety departments & schools. hillsborough county property records. Hillsborough County New Hampshire Property Tax.

From suburbs101.com

New Hampshire Property Tax Rates 2023 (Town by Town List) Suburbs 101 Hillsborough County New Hampshire Property Tax search our extensive database of free hillsborough county residential property tax records by address, including land & real. From your local public safety departments & schools. hillsborough county property records (new hampshire) find comprehensive property information in hillsborough county, nh. new hampshire residents all pay a county portion of their property taxes to their local government, which. Hillsborough County New Hampshire Property Tax.

From karolynhudgins.blogspot.com

nh property tax rates per town Karolyn Hudgins Hillsborough County New Hampshire Property Tax Please follow the instructions below to make a payment and/or review your account. The average effective property tax rate in merrimack county is 2.52%. the town of hillsborough tax assessor's office oversees the appraisal and assessment of properties as well as the. From your local public safety departments & schools. search our extensive database of free hillsborough county. Hillsborough County New Hampshire Property Tax.

From movingist.com

What is the Average New Hampshire Property Tax in 2022 Hillsborough County New Hampshire Property Tax paying my property taxes. new hampshire residents all pay a county portion of their property taxes to their local government, which is passed on to. Please follow the instructions below to make a payment and/or review your account. search our extensive database of free hillsborough county residential property tax records by address, including land & real. . Hillsborough County New Hampshire Property Tax.

From warnerpartridge.blogspot.com

nh property tax rates per town Warner Partridge Hillsborough County New Hampshire Property Tax the town of hillsborough tax assessor's office oversees the appraisal and assessment of properties as well as the. search our extensive database of free hillsborough county residential property tax records by address, including land & real. the tax collector’s responsibilities are to collect all monies for property taxes, water and sewer bills, yield and excavation. Please follow. Hillsborough County New Hampshire Property Tax.

From rowqvinnie.pages.dev

Nh Property Tax Rates By Town 2024 Prudi Carlotta Hillsborough County New Hampshire Property Tax hillsborough county property records (new hampshire) find comprehensive property information in hillsborough county, nh. search our extensive database of free hillsborough county residential property tax records by address, including land & real. paying my property taxes. Please follow the instructions below to make a payment and/or review your account. The average effective property tax rate in merrimack. Hillsborough County New Hampshire Property Tax.